With the need for higher energy efficiency and the push toward environmental sustainability, upgrading your home HVAC to an energy-efficient gas furnace or oil furnace is more important than ever. The Inflation Reduction Act of 2022 has paved the way for significant incentives to go green with your HVAC system, making 2024 a prime year for homeowners like yourself who need to upgrade their heating systems and save money on taxes at the same time. On this page, I’ll help you more about State and Federal tax rebates for high efficiency home heating and air conditioning systems. You can also view our list of the best high efficiency gas furnaces along with their approximate installed pricing to learn more.

Federal Income Tax Credits for High Efficiency Furnaces

Energy Efficient Home Improvement Credit

From Jan. 1, 2023, homeowners who make qualified energy-efficient improvements, including furnace upgrades, may qualify for a tax credit of up to $3,200. The energy efficiency credit (Learn more at the IRS website) was initiative is designed to encourage the adoption of greener technologies in residential spaces.

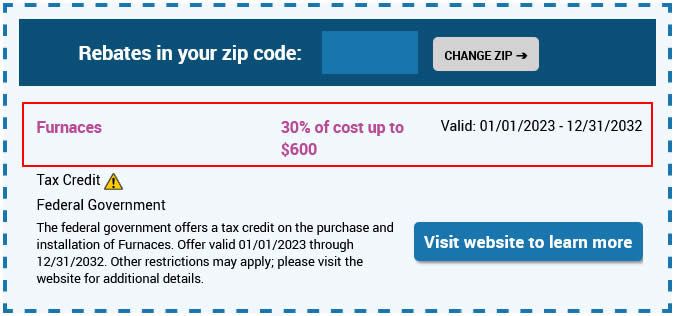

For furnaces, the tax credit amount was increased from $300 in 2022, to 30% of the cost, up to $600 for 2023 through 2032.

Eligibility for Furnace Tax Credits and Rebates

ENERGY STAR certified gas and oil furnaces are eligible for the 30% or a maximum $600 in tax credits and rebates. The focus of the program is on promoting the highest efficiency models to maximize energy savings. The specifics of eligible products and annual limits on tax credits can be found on this page of the Energy Star program.

Additional HVAC System Tax Incentives

In addition to furnaces, homeowners can also benefit from tax incentives on other HVAC system components. This includes central air conditioning systems, boilers, smart thermostats, water heaters and heat pumps.

Local Energy Incentives and Professional Assistance

Local utility and energy incentives for high-efficiency heating and cooling products are also available and not always promoted openly. The best place to learn about local tax credits for HVAC is through the DSIRE database, which contains the latest information on these incentives.

Contacting a local HVAC professional in your area will also help you understand how to get the most of the incentive programs both at the national and state level. Schedule a free consultation today.

Maximizing Tax Credits and Rebates

To maximize your benefits from these tax credits and rebates, you should consider spreading your HVAC system upgrades over a few years. Combining different upgrades can be a strategic way to increase your overall savings and taking advantage of all the benefits the programs offer.

2024 presents an excellent opportunity for you to upgrade to energy-efficient furnaces, thanks to the array of government and state rebates and incentives. By taking advantage of these offers, you can contribute to environmental sustainability while also enjoying significant financial savings.